Trinidad is not going to produce gas in Venezuela's Dragon field anytime soon

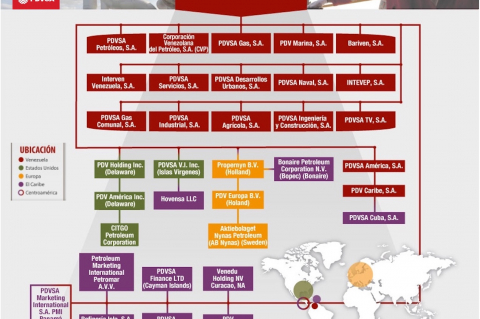

Reuters reported days ago that U.S. Treasury had granted a license to Trinidad & Tobago to develop, manage, and market gas produced in Venezuela's Dragon Field. Trinidad's National Gas Company (NGC), Petroleos de Venezuela (PDVSA) and Shell would expectedly be jointly in charge of development, production, operational and marketing aspects. Payment -for such gas- would be made by Trinidad & Tobago to Venezuela in humanitarian aid.