Further to recent lawsuit pitting PDVSA against some of world’s largest oil traders, leaked documents show that PDVSA wanted to establish a trading company in Geneva, under a “non-incorporated Joint Trading Venture” with Trafigura, one of the 49 defendants named in PDVSA’s lawsuit.

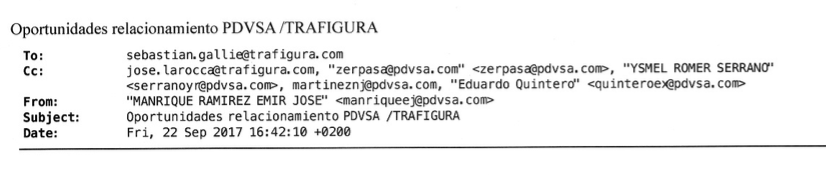

According to filed documents, in late July 2017, PDVSA allegedly instructed American law firm Boies, Schiller & Flexner to form a trust (PDVSA US Litigation Trust), to pursue “...recovery for Defendants’ misconduct”. This included bribe payments to corrupt PDVSA officials to gain real-time access to PDVSA’s servers, in order to rig bidding processes and favour a group of energy trading companies among which Trafigura. Internal communications between PDVSA and senior Trafigura officials show that in late September - early October 2017, Trafigura was discussing a $700 million “Collateralized Prepayment Facility” with Emir Jose Manrique Ramirez, PDVSA’s Head of Financial Planning.

Setting up a Geneva-based “non-incorporated Joint Trading Venture” between PDVSA and Trafigura was part of the negotiation.

Trafigura claimed that the local canton of Geneva was “very accommodating to trading companies and has an efficient tax system”, while boasting about its “expertise” and “relationship with the local authorities.”

In exchange for $700 million “Collateralized Prepayment Facility”, Trafigura expected 350,000 BPD (10.5 million barrels of crude oil per month over a three month period), which PDVSA should provide in “segregated... offshore acceptable locations...” that would be “inspected on a weekly basis by a surveyor.”

US Sanctions compliance, meanwhile, were to be circumvented by setting the Euro as “currency of the offtake contract and prepayment agreement”. Singapore-incorporated Trafigura Pte Ltd was proposed as PDVSA’s counterparty. English law was to govern the deal, and, under warranties, Trafigura explicitly refused to accept “default, material adverse change, and sanctions” as potential contract breaches by PDVSA.

If anything, leaked information reveals that PDVSA -whether under previous or current management- continues to be an utterly corrupt company, for how can such deals between litigating parties be explained? Trafigura stands accused, among 48 other defendants, of causing in excess of $5 billion worth of losses to PDVSA. While PDVSA’s lawyers were preparing a case against Trafigura et al, senior management at the company were looking to do deals with one of the principal defendants in launched lawsuit. Trafigura -PDVSA deals over the years are estimated to have exceed $40 billion.

It did not end there though. Sources have reported that in late 2017, Venezuela’s VP Tareck el Aissami (one of the main brokers in a new power-sharing management system implemented by Nicolas Maduro in PDVSA after removal / arrest of Rafael Ramirez’s team) instructed Armando “Pelón” Capriles to pursue a similar, off-the-books kind of deal, with Trafigura and Gazprombank. In this instance, Trafigura’s Patricio Norris is said to be part of fresh negotiations with Fernando del Quintal (PDVSA’s Head of Commerce and Supply) and Boris Ivanov (VP of Gazprombank).

Trafigura and Gazprombank are, of course, right at home in Venezuela. Trafigura has been involved in the country for well over a decade. PDVSA US Litigation Trust’s lawsuit has taken aim at Francisco Morillo, a former employee of Wilmer Ruperti when Ruperti was Trafigura’s rep in Venezuela. Once disgraced, Ruperti has been actively mending his business relations with chavismo. He paid Boies, Schiller & Flexner legal defence fees of President Nicolas Maduro’s cocaine-trafficking nephews, and according to various sources familiar with proceedings is involved in the lawsuit against former protegé, and rival, Morillo through the Litigation Trust. PDVSA's choice of trading partner (Trafigura) isn't gratuitous, considering Ruperti's past and current involvement.

Gazprombank also has some pedigree in Venezuela. Instead of cutting deals directly with PDVSA, given Andrey Akimov's proximity to Putin and the latter gravitas over Chavez / Maduro, it chose perhaps the stinkiest local partner (Derwick Associates), which is involved in multiple corruption scandals being probed in various jurisdictions. Just why would Gazprombank chose to get involved with Derwick is anyone’s guess, though it seems that Russian and Venezuelan politicians, entrepreneurs, bankers and oilmen share a knack for illegality and corruption.

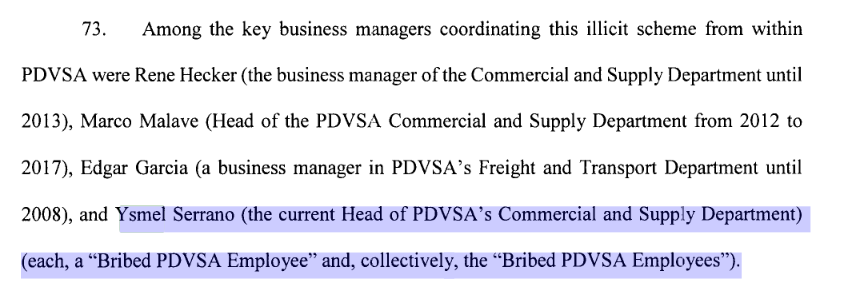

However apt to operate in desperately corrupt environments though, a number of difficulties stand in the way of PDVSA’s new strategy. U.S. Sanctions, for one. Army man Manuel Quevedo, PDVSA’s new CEO and Minister of Energy, is a puppet of Diosdado Cabello, perhaps the world’s most wanted chavista. Ysmel Serrano, PDVSA’s VP, is nothing more than a proxy of Tareck el Aissami, a Treasury-designated kingpin. Armando “Pelón” Capriles, first cousin of Miguel Angel Capriles Lopez, is also involved in illegal transactions with el Aissami, and has a rather large catalogue of crooked deals in Venezuela since the early 90ies. Gazprombank too is a U.S.-sanctioned entity, as well as CEO Andrey Akimov and Andrei Kostin, head of VTB Bank, which controls about a quarter of Evrofinance, one chavismo's favourite underwriters.

Then Switzerland, Trafigura’s centre of operations, has imposed sanctions on Gazprombank. Swiss financial authorities have also sanctioned a number of Venezuelan officials (Cabello among them), and are currently sharing banking information, at the request of U.S. Justice Department, for various probes into PDVSA and Venezuela.

Interestingly, Ysmel Serrano has been named as one of PDVSA’s “bribed officials” by the litigating Trust. Another defendant is Switzerland’s EFG Bank, which is at the core of a separate and about to explode $4 billion graft scheme involving former PDVSA CEO (Rafael Ramirez), Luis Oberto, and Nervis Villalobos (arrested), one of Ramirez’s main facilitators. Yet another case prompted Swiss authorities to turn over to American prosecutors information pertaining Roberto Rincon (indicted). Derwick Associates has been fighting Swiss authorities to impede sharing with DoJ compromising banking information related to its contracts with PDVSA. Thus, it would appear that nearly every party to a potential PDVSA – Trafigura venture is already compromised, fresh sanctions against close Putin associates and Russian State-controlled enterprises complicate the scenario even more.

So Swiss banks and energy trading companies are a common denominator of most corruption scandals related to Venezuela, however Trafigura has some form protecting the corrupt through their excellent "relationship with the local authorities."

On a separate note, Vladimir Putin is meant to have called on chavismo to start amortising huge amounts owed by Venezuela to Russia. Gazprombank’s presence in current negotiations could guarantee, at the very least, payment of some principal. Petrozamora, the PDVSA – Gazprombank / Derwick joint venture, is producing 130,000 BPD according to Ivanov. Surely the Chinese will have some questions about preferential treatment to (some) creditors.

Venezuela, on the other hand, has all but defaulted on its international debt obligations since September 2017. Close to $10 billion are due in principal and interest payments in 2018. Every bondholder and creditor is following PDVSA / Venezuela every financial move, and formulating strategies to seize whatever asset could be captured. Hence Trafigura's warranty demands. Beyond mounting number of criminal probes, there’s growing appetite in international financial and legal circles for “low hanging fruit”, i.e. Venezuelan assets liable to seizure. Hedging, like the one pulled by Rosneft on CITGO, is likely to be turned on its head by suing investors and/or U.S. authorities. In the hypothetical case of a favourable settlement for PDVSA US Litigation Trust, multiple claims against recovered funds will undoubtedly be presented by a myriad of aggravated parties. Argentina’s default and ensuing alter ego legal arguments are going to look like parking fines’ debates, next to what’s coming to Venezuela once its gargantuan corruption gets aired.

With ever diminishing oil production, lack of debt-free collaterals, international sanctions, impossibility to forge new partnerships, lack of investment and access to fresh funding, hefty cost to ramp up production, and a local crisis described as of humanitarian, war-like proportions, chavismo’s manoeuvrability is very limited indeed. Attempts to circumvent this reality, by covertly playing partners against one another, isn’t certainly going to help Venezuela. It shall be fascinating to see the reaction of the other 48 defendants to this news.

Request for comment were sent to PDVSA’s Manrique and Serrano, to Trafigura’s Sebastian Gallie (Trading) and to Christophe Salmon (CFO). No reply has been received.